In this years budget the government made changes to the depreciation rules surrounding plant and equipment in investment properties.

A number of clients contacted us asking about whether these changes would affect their current situation. The good news for those who signed a contract before the budget was announced, these new rules do not affect you. Anyone who signed a contract prior to 7.30pm on the 9th May 2017 can continue to claim their depreciation deductions as normal.

Any investor who purchases a brand new property will also be able to continue to claim the depreciation deduction on their plant and equipment as they were able to in the past.

The only investors who are affected are those who have purchased or are intending on purchasing an investment property that is not new. E.g. someone who purchases a property that is 2 years old. These investors will be limited to claiming “Capital Works Deductions”

But how does this impact the investors?

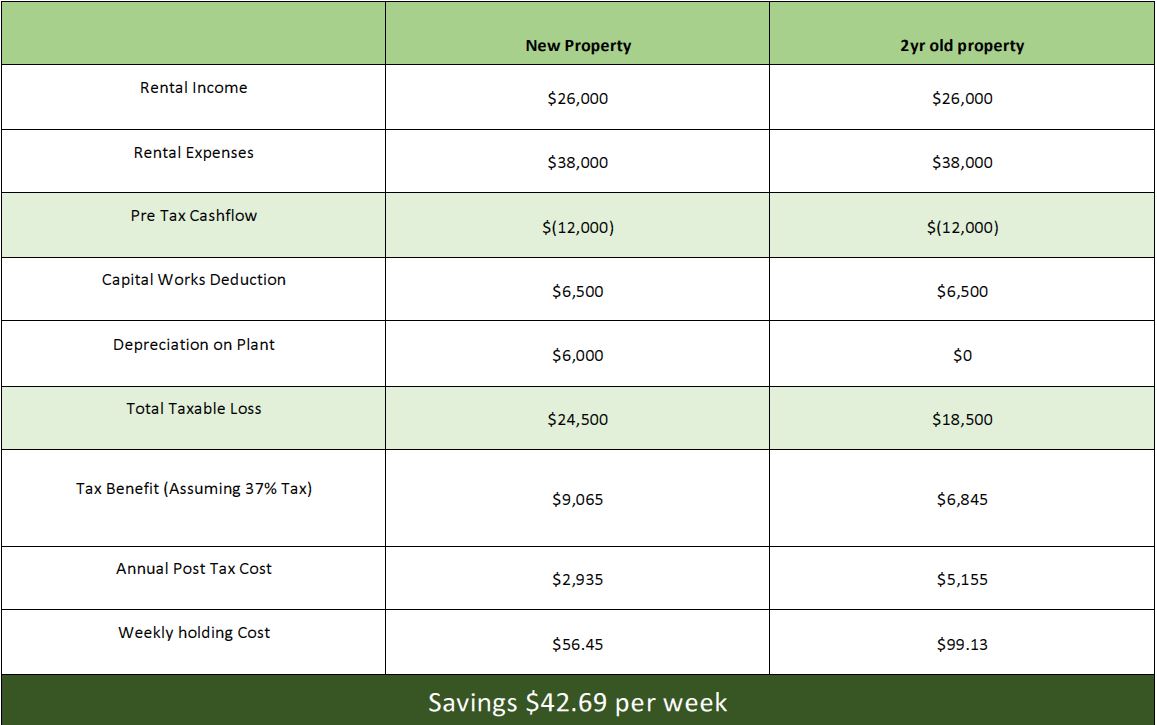

Let’s take an investment property that costs $600,000 and returns $26,000 per annum in rent ($500 per week) and has costs (interest, rates, water, body corporate etc.) of $38,000 per annum. Depreciation on the building would total $6,500 (approx.) and in year 1 the depreciation on the plant and equipment around $6,000. We can see in the table below how this impacts the investor:

By utilising the depreciation on plant and equipment we managed to reduce the cost of holding this property by $42.69 per week. This is a worked example only and would change depending on individual circumstances.

Please contact us to find out more. If you would like to attend a free property investment seminar we have 2 running on the 16th October. One in the morning and one in the evening.