Many people purchase a holiday home as a lifestyle asset with no intention of ever generating an income from it. It will never be rented out, meaning the interest, rates, lawn mowing, repairs, etc. are not tax deductible. Because these items are non-deductible, the owner will often give scant regard to record keeping when it comes to costs associated with the holiday house.

This could end up costing you a small fortune in Capital Gains Tax when you go to sell the property. Every property you buy and sell is subject to capital gains. The home you live in is exempt from Capital Gains Tax under the Principal Place of Residence exemption, but other properties will be subject to Capital Gains Tax. If you own the property for more than 12 months, you will get a 50% discount on the gain, so only pay tax on half of it.

So, in simple terms, if you bought the house for $300,000 and sold it in at least 12 months’ time for $500,000 you would have to pay tax on $100,000 at your marginal rates ($200,000 gain on sale with a 50% discount).

This is where is becomes interesting for Holiday Home Owners. Whilst you have to pay capital gains tax on the gain there are ways to reduce the amount you need to pay. There are a few different elements that add to the cost base of the property. They are as follows:

- Acquisition Costs

- Purchase Price of the holiday house

- Incidental Costs

- Costs incurred on the purchase (legals, conveyancer, accountants, advisers, borrowing costs, etc.)

- Costs on the transfer of the property (title fees, registration of mortgage etc.)

- Stamp Duty

- Costs to sell the property (Agent fees, advertising, valuations, etc.)

- Ownership Costs

- Interest on borrowing to buy the property

- Costs to maintain the holiday house (lawn mowing, repairs, rates, water rates, etc.)

- Capital Costs

- Renovations and improvements

- Demolition costs, etc.

- Title Costs

- Costs such as legal fees to preserve or defend the title of the property.

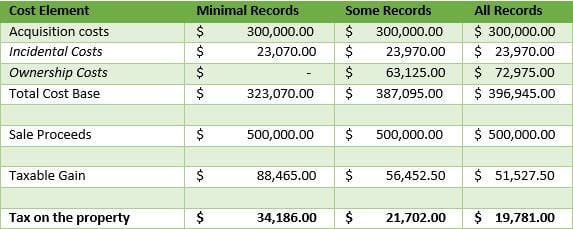

Lets compare the same property and assume it has one owner who earns $80,000 per year from their ordinary job. The property is purchased for $300,000 and 5 years later sold for $500,000. We will assume one owner had records of the major items but didn’t keep any records for ongoing costs.

*Full Calculations at the bottom of the article.

*Full Calculations at the bottom of the article.

In this instance, the taxpayer who has kept all of their records since owning the property were able to reduce their tax on the property by $14,405.

Just by making these adjustments and keeping better records of every cost incurred on the property, you may be able to save yourself a small fortune in tax.

Article Written by Paul Wineberg

Paul is a member of the Institute of Chartered Accountants, a Certified Management Accountant

and a Director of South East Accounting.

DETAILED CALCULATIONS:

| Cost Element | Minimal Records | Some Records | All Records |

| Acquisition costs | $ 300,000.00 | $ 300,000.00 | $ 300,000.00 |

| Incidental Costs | |||

| Stamp Duty | $ 13,070.00 | $ 13,070.00 | $ 13,070.00 |

| Borrowing Costs | Unknown | $ 700.00 | $ 700.00 |

| Title Fee | Unknown | $ 200.00 | $ 200.00 |

| Selling Costs | $ 10,000.00 | $ 10,000.00 | $ 10,000.00 |

| Ownership Costs | |||

| Interest on Borrowings | Unknown | $ 56,250.00 | $ 56,250.00 |

| Bank Fees | Unknown | $ 1,875.00 | $ 1,875.00 |

| Lawn Mowing | Unknown | Unknown | $ 2,400.00 |

| Rates | Unknown | $ 5,000.00 | $ 5,000.00 |

| Water Rates | Unknown | Unknown | $ 3,600.00 |

| Gardening Costs (plants etc) | Unknown | Unknown | $ 1,250.00 |

| Repairs on the property | Unknown | Unknown | $ 2,600.00 |

| Total Cost Base | $ 323,070.00 | $ 387,095.00 | $ 396,945.00 |

| Sale Proceeds | $ 500,000.00 | $ 500,000.00 | $ 500,000.00 |

| Capital Gain | $ 176,930.00 | $ 112,905.00 | $ 103,055.00 |

| Taxable Gain | $ 88,465.00 | $ 56,452.50 | $ 51,527.50 |

| Taxable Income | $ 168,465.00 | $ 136,452.50 | $ 131,527.50 |

| Total Tax | $ 53,333.00 | $ 40,849.00 | $ 38,928.00 |

| Ordinary Tax | $ 19,147.00 | $ 19,147.00 | $ 19,147.00 |

| Tax on the property | $ 34,186.00 | $ 21,702.00 | $ 19,781.00 |